Beyond bitcoin: Blockchain’s promise of energy choice, control, and trust

Blockchain technology today is about where mobile technology was 30 years ago. It’s still in its infancy, with its future unclear. And it’s growing with incredible momentum.

But this decentralized database technology still suffers from a perception issue. Much of the public confuses blockchain with bitcoin—which makes some sense, as the cryptocurrency remains blockchain’s first and best-known application.

Full disclosure: as an early bitcoin proponent, I had trouble at first understanding how the underlying technology could fundamentally change networking, data management, and security. Fast forward to today, though, and I’m seeing how blockchain could emerge as a rudimentary approach to solving some of the world’s toughest problems.

Blockchain development and collaboration is unfolding before our eyes. Its potential is already clear to investors.

More than 200 venture capital deals in blockchain raised more than $1.3 billion in the first nine months of 2018, and traditional blockchain venture financing sees an average of $3 million for early-state deals. More than 50 startups have launched in the blockchain energy market segment since 2017, tackling use cases of energy trading, balancing, and verification.

But I believe the most remarkable outcome of the technology could be the way it promotes collaboration in highly regulated sectors. Has the energy sector ever seen regulators, utilities, and customers collectively explore concepts like data sharing, security, and transparency, all under one umbrella?

Bye-bye, bottlenecks

Financial institutions are already looking far beyond digital currencies, testing blockchain for operational efficiencies. The technology is helping banks turn painful, months-long, easily bottlenecked clearing-and-settlement process into instantaneous transactions.

I can see blockchain similarly transforming the energy industry’s operational efficiency and data transparency. The settlement between energy trading parties today can take as long as 90 days. But blockchain, using flexible tools like smart contracts and transaction validation, could cut that lag down to hours, freeing up funding and time for more critical operations.

And just as the shipping industry is testing blockchain to verify sourcing, utilities could use it to verify local renewable energy sources and carbon credits, so customers know their energy comes from a local solar site, hydroplant or wind farm.

Power to the customer

I don’t think the buzzword “blockchain” fully describes its potential for the energy and utilities sectors. I prefer to describe it is as a tool for “transactive energy”: a decentralized, secure, transparent network that’s poised to disrupt the energy grid.

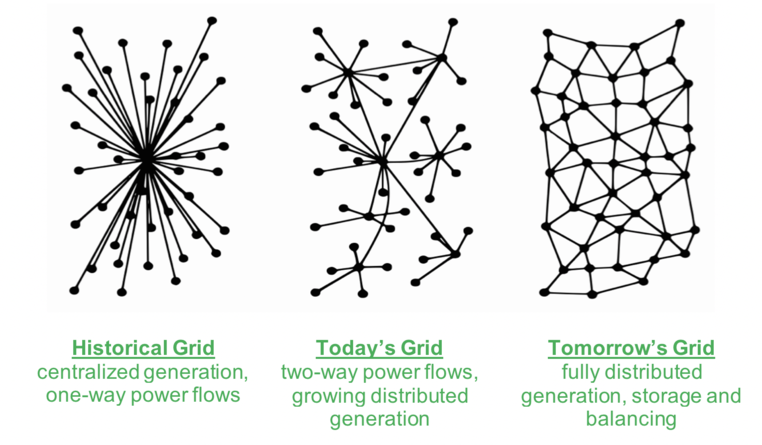

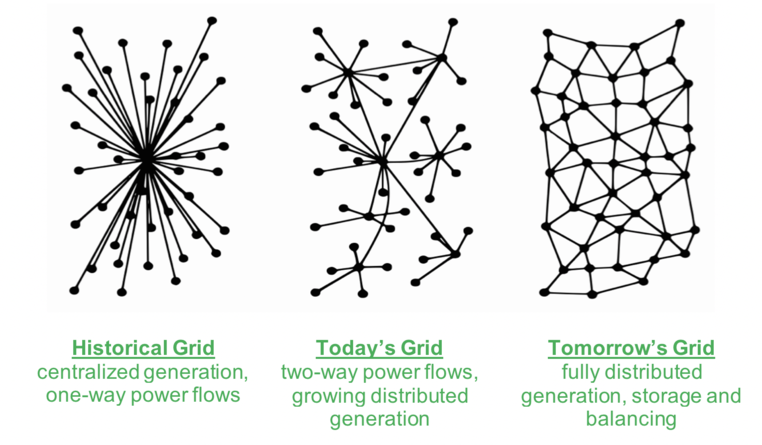

How? Think of the historical grid model, which distributed energy from one centralized source in one-way power flows to utilities and customers. Today’s grid incorporates two-way power flows, with growing distributed generation and storage. But the transactive energy model reimagines the grid as a decentralized network, incorporating fully distributed generation, storage, trading, and balancing into a more autonomous and digital system.

This model could bring us greater democratization. Rather than a utility or third party managing customers’ energy use, a transactive energy network can validate and approve energy activity, giving customers greater control over their usage. That’s a matter of increasing interest as electric vehicles and solar or storage services gain prominence.

Then there’s the matter of cutting through red tape. Your customers expect autonomy, but those who want to enable energy services have to run an obstacle course—shutting down their service, opening or closing an account, picking up the phone and setting up the service again. A blockchain-powered grid would help customers manage their own data and enable services quickly and effortlessly. Even better, it could help utilities share anonymous leakage and outage data securely and privately, so we can find trouble spots quickly.

These are just a few of the concepts we’ve researched with the New York Joint Utility Blockchain Consortium, and we can’t wait to learn more. We’re probably three to five years out before we’ll see mature blockchain solutions in energy. But I have no doubt that blockchain’s about to start growing up fast.

Matthew Bloom is Lead Analyst for Innovation at National Grid Partners.